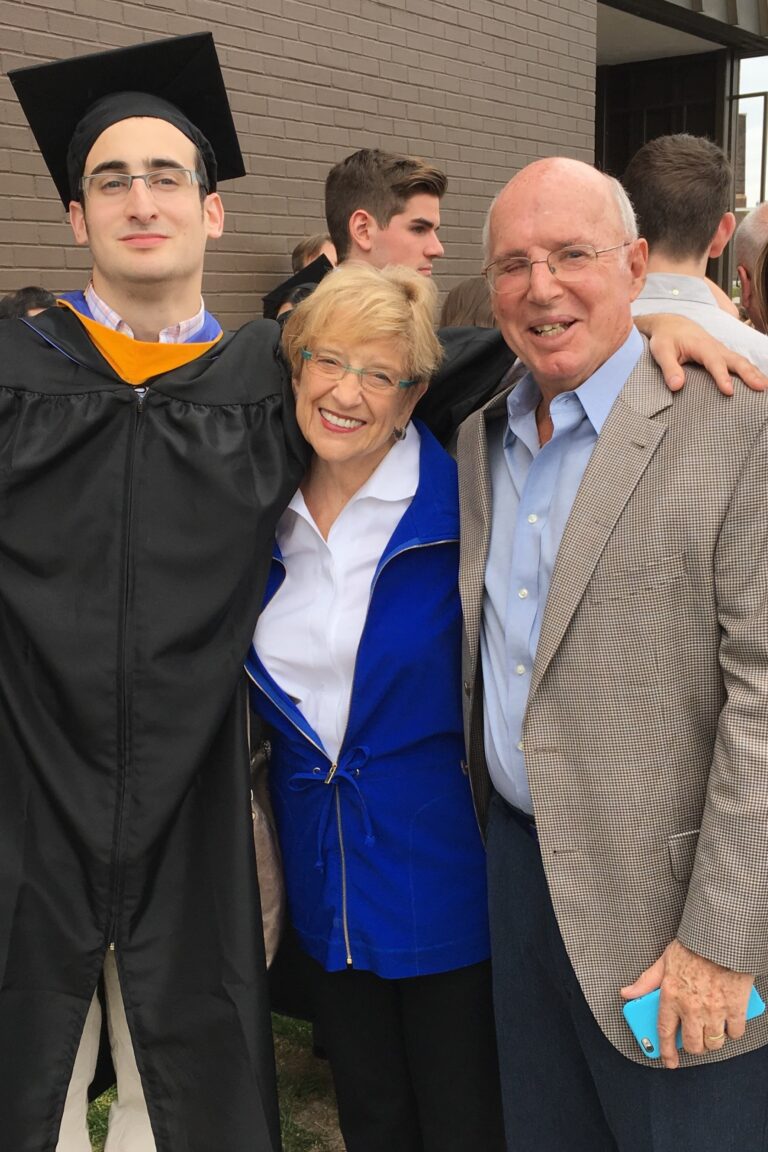

The Miller Good family’s multi-generational support of JFSA is as exceptional as it is inspiring. Their legacy begins in the 1950’s with matriarch and former JFSA Board Chair Anne Miller*. “My grandmother’s first love was JFSA,” explains Sid Good, a third generation board member. “Even after her term as President was completed in 1956, she remained an active board member for many, many years. Helping others was her passion.”

That passion endures today as the Good family continues to serve the community. Anne’s daughter and JFSA Life Director Sally Good helped launch the Families at Risk division. She and Sid also serve on several JFSA committees and participate in agency volunteer activities, often recruiting the fourth generation of Goods to get involved. “Giving back to the community is just something you do,” says Sid. “I grew up watching my grandparents and parents help others. Those are values I know my niece and nephews are learning, too.”

One reason the Good family continues to support JFSA is the dynamic nature of the agency. “JFSA has kept up with the times,” explains Sally, who notes that the needs are continuous, but ever changing. “JFSA has always been one step ahead of the curve,” adds Sid. But anticipating needs is only part of the equation. “It’s the quality of the services we offer that has sustained the agency for 140 years. At the end of the day it’s all about caring for those in need,” says Sid. “That was something that my grandmother always understood. I think she’d be thrilled with JFSA today.”

JFSA helps individuals and families with

JFSA helps individuals and families with